The Auditor-General has indicted some public companies and corporations for mishandling workers funds as well as taxes they should have paid to the Ghana Revenue Authority.

The Auditor-General cites the Ghana Post Company Limited, Ghana Airport Company, Graphic Communications Group Limited, The New Times Corporation (popularly called Ghanaian Times) and the Architectural and Engineering Services Limited (AESL) for malpractices including failing to pay taxes, pensions and insurance deductions to respective institutions and funds.

It must be stated that many of the findings relate to occurrences in 2017, 2018 and 2019 financial years even though the details are captured in the Report of the Auditor General on the Public Accounts of Ghana – Public Boards, Corporations and Other Statutory Institutions for the year ended 31 December 2020.

Trend

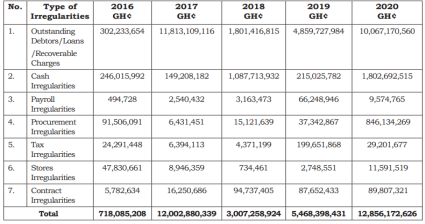

The Auditor-General reveals that the total financial irregularities found in this round of audit at public boards, corporations and other institutions stood at GH¢12,856,172,626 as at the end of December 2020.

This is the highest amount of irregularities discovered in this category of public organisations in the past five years. Cash irregularities, procurement irregularities, stores irregularities and contract irregularities all increased well above 2019 levels.

The Auditor-General said that the “operational results and financial positions of the Public Corporations and other Statutory Institutions during the period under review, could have been healthier if there had been effective supervision of schedule officers.”

Consequently, “I reiterated my advice to Managements to strengthen their Internal Audit Units to ensure effective and efficient internal control systems.

“I also recommended that Managements should establish and strengthen the Audit Committees within the organisations” in accordance with the Public Financial Management Act, 2016 (Act 921) to ensure that audit recommendations are duly implemented, the Auditor-General stated.

Specific cases

The Auditor-General also highlighted specific cases of financial irregularities, including those committed by some state-owned enterprises.

At the Ghana Post Company Limited, the Auditor-General discovered from a review of the 2018 payroll that the Company deducted a total of GH¢3,447,961.45 as Pay as You Earn (P.A.Y.E.) tax from the salaries of employees but did not transfer the amount to the Ghana Revenue Authority (GRA).

According to the Auditor-General, the conduct of the company is as a result of Management’s override of the tax laws, especially Sections 114 and 117 of the Income Tax Act, 2015 (Act 896).

It was recommended to management “to ensure that the total tax of GH¢3,447,961.45 is paid to GRA as soon as practicable.”

In addition, the Auditor-General indicted Ghana Post for breaching procurement rules when it made purchases amounting to GH¢266,110.54 on eighteen (18) payment vouchers without obtaining alternative quotations from other sources thereby defeating the purpose of ensuring value for money.

Furthermore, it was discovered that Ghana Post breached Section 7 of Public Financial Management Act when it paid an amount of GH¢48,625.00 to an HR consulting firm without proof of work done.

The amount was paid in 12 instalments from January to December 2018 but “Management was unable to furnish the audit team with a copy of the contract…though it was requested through the Head of Human Resource,” according to the Auditor-General.

As a result “We urged Management to ensure that the amount of GH¢48,625.00 is duly accounted for, failing which Management should be held liable,” the AuditorGeneral recommended.

Elsewhere, the Ghana Airport Company broke the law by spending beyond its approved budget without an approved supplementary budget by the Board. The amount involved in the budget overrun was about 25.7 million cedis.

“We further noted that the Company provided budgetary support of GH¢1,396,982.45 to Aviation Social Centre, a subsidiary of the Company to procure gymnastic equipment and renovation works which was not included in the approved budget,” the A-G said.

Furthermore, the auditors noted that deduction from staff salaries towards staff welfare and other individual insurance policies amounting to GH¢7,553,997.10 for the period May 2019 to December 2019 had not been transferred by Management to the various fund accounts.

“We recommended to Management to urgently make payment to all the various fund accounts,” said the A-G.

The report also states that management accepted full responsibilities for the nonpayment of staff welfare related deductions and added that about 80% of such deductions had been honoured in 2020.

In the case of the Architectural and Engineering Services Limited (AESL), the Auditor-General found that a total amount of GH¢15,965,058 due the GRA and Social Security and National Insurance Trust (SSNIT) was not remitted as at 31 December 2019.

According to the Auditor-General, AESL blamed the anomaly on debts that some ministries, department and agencies owed. The “MDAs owe AESL a total of GH¢30.9 million as at 31st December, 2019. The VAT component of the MDAs indebtedness is part of the outstanding VAT liability.”

Another of the public companies indicted is the New Times Corporation. According to the Auditor-General, management “had over the years not been remitting both its own 5% contributions and the employees’ 5% deductions from staff salary to the Fund Manager. This resulted in an outstanding balance of GH¢1,018,311.39 owed the fund by both the Corporation and the Staff.

This lapse was caused by Management’s lack of will to set up an independent Board of Trustees to ensure that the fund is properly managed, remittances regularly made, and financial conditions of the Fund Manager and the status of members’ contributions with the Fund Manager closely monitored.

In our follow-ups, Corruption Watch learned that the amount involved has shot up to about 1.2m cedis, causing frosty relations between workers and management.

At the Graphic Communications Group Limited, where the Auditor-General examined accounts for 2017 and 2018, it was discovered that “there were delays in the payment of the Tier Two Pensions contributions on behalf of the employees of GCGL during the year under review.”

The A-G said that management “admitted cash flow challenges during the year as the main reason for their inability to comply with the Provisions of Act 766.”

However, the A-G cautioned that “Delays in the payment of employees’ pension contributions could lead to sanctions of three percent compounded monthly on the unpaid amount. This could also lead to employee agitation should it become known to staff of GCGL which could negatively affect the operations of the Company.”