The cost of health care is a topic for debate in most countries. It is because it places a significant burden on the government and the citizens of any country. In Africa, the costs are increasing further because of the impact chronic disease are having. Several reasons can be given for the increase in Africa’s chronic disease burden. They include:

- Increased life expectancy: As a result of comparatively fewer deaths from infectious diseases, Africa is experiencing a demographic shift towards an ageing population even though the median age on the continent still makes it relatively youthful compared to others. As people live longer, they are more likely to develop chronic diseases such as diabetes, hypertension, and cancer.

- Urbanization: This has brought about lifestyle changes, including sedentary behavior, increased tobacco and alcohol consumption etc. These acts result in injury to organs and systems in the human body as we age and compound the chronic disease burden.

- Unhealthy Diets: The consumption of substances such as salt, sugar and fats is a major contributor to the increased incidence of chronic diseases on the continent. Compounding the situation further is the increased availability of fast-food outlets which often rely on processed foods, red meat and sugary drinks.

- A lack of physical activity: This is a positive predictor of potential heart disease, diabetes and hypertension. Further, a lack of proper settlement planning has limited access to safe and demarcated areas for physical activity.

On a continent where access to healthcare can be a challenge, many governments find themselves grappling with the problems of increasing access to healthcare, minimizing the cost of care to the end user, retention of health human resources and an increasing population.

The situation around the funding of healthcare in Ghana can be viewed in this context too. Thus although the country’s health expenditure per capita increased from US$76.64 in 2018 to US$94.66 in 2021, the percentage of this that was a result of government spending was 36.5% in 2018 (US$27.97) and 37.2% (US$35.21) in 2021. This means the public is increasingly paying more as out-of-pocket payments or through private health insurance for healthcare. This is because the out-of-pocket expenditure per capita on health increased from US$48.67 in 2018 to US$59.45 in 2021.

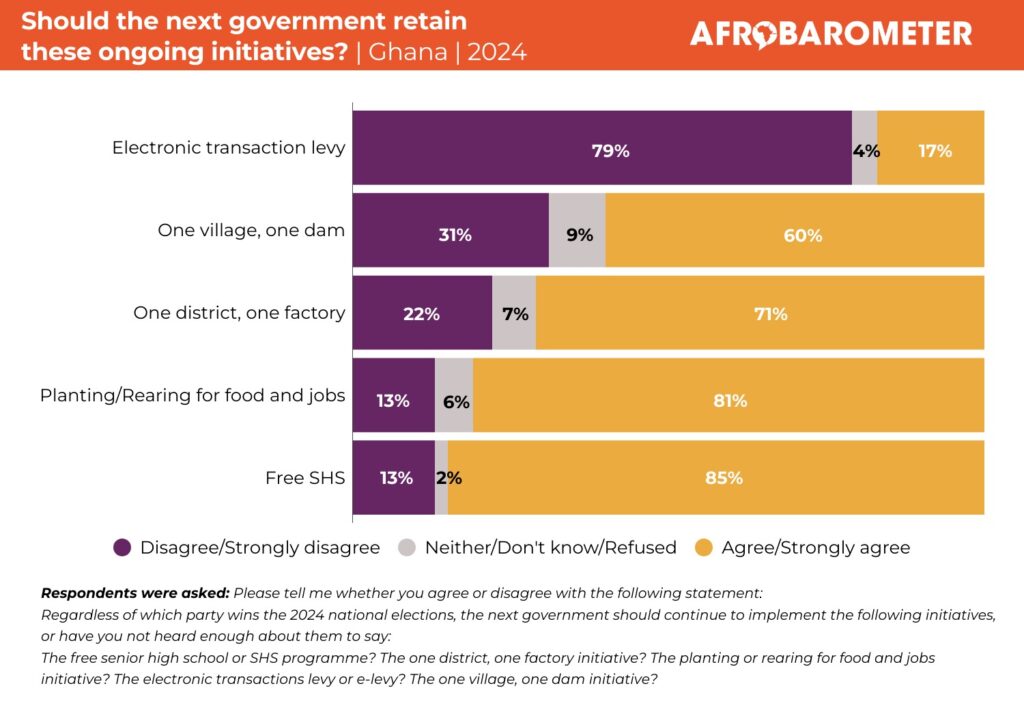

Considering a study conducted by the Government of Ghana and the World Health Organization (WHO) in 2019, indicated that the financial cost of chronic diseases on Ghana’s health bill was estimated to be about $1.02 billion annually and the figure is projected to rise, the government has moved to impose taxes on the human and behavioural contributors to chronic disease. In principle, this could be said to be a low-hanging fruit but in practice is it? Can the tax introduced be seen as a health intervention or rather an attempt to raise revenue?

This form of taxation known as “Sin Taxation” is often designed to levy goods and services that are considered harmful to health with the potential of increasing the chronic disease burden. As stated earlier examples are tobacco, alcohol, and sugary drinks. These levies aim primarily at discouraging the consumption of these products to improve public health. However, the evidence suggests that this ideal is often not achieved and sin taxes can disproportionately affect low-income households. In South Africa, the government has been criticized for its over-reliance on the introduction of sin taxation while failing to address the root causes of obesity, such as poverty and lack of access to healthy foods.

Considering that a recent report by the Alliance for a Green Revolution in Africa (AGRA) indicated that 65% of Ghanaians cannot afford a healthy meal, it is important that moving forward the impact of this new tax on sin behaviors is monitored so as not to worsen the access to healthy eating. If it is determined that rather than serve as a deterrent the consumption of these taxable products increases or remains stagnant then the model of implementation of this tax handle will have to be reviewed. That is if this is seen as a health intervention. However, if this is a revenue generation drive then a failure to achieve behavioral change may just be the outcome.

I hold this view because another component of sin taxation is to create a fund that aims at chronic disease management of citizens should they develop the diseases associated with their lifestyle. Sin funds are not new. They are a public health funding mechanism that collects revenue from sin taxes and allocates them towards programs that promote public health and optimize the management of chronic diseases. They ensure the following;

- Cost-effective funding: They provide a reliable source of funding for public health programs and initiatives and ensure that the revenue from taxation is used to address the chronic disease pain point down the line without burdening the state.

- Dedicated funds: Sin taxes can be used to help fight specific chronic diseases or risk factors like smoking, drinking too much alcohol, or being overweight. Because of this, authorities in public health can direct their efforts and resources toward the required areas.

- Promotion of healthy living: Sin funds can be used to encourage healthier habits and lifestyles. Programs that encourage people to choose healthier beverages like water or unsweetened tea, for instance, can be funded with money from taxes on sugary drinks. Even then the impact of illegal mining on the quality of water in the country may be a hindrance. This could be thought of as front loading to decrease the financial burden of chronic diseases in later life thereby improving the quality-adjusted healthy years of the population.

- Healthcare cost savings: As a result of preventing or delaying the onset of chronic diseases and reducing the burden of chronic disease on the healthcare system through effective chronic disease management, sin funds can assist in lowering healthcare costs.

- Promoting a just society: By providing funding for public health initiatives that benefit disadvantaged populations with a higher risk of chronic disease, sin funds can promote social justice.

Thus, rather than this money being paid into the consolidated fund, it may need to be ring-fenced like the National Health Insurance Levy and invested in the Ghana Health Service’s activities targeting chronic diseases. Even if that was done there will have to be legal checks that prevent any finance minister from withholding such funds and releasing them as they deem fit based on their own identified priorities. This view is a result of historical challenges in the release of the National Health Insurance Levy to the NHIS by the Finance Ministry.

With the President signing this tax into law without the existence of a designated sin fund, there is the risk that at a time when Ghana is seeking an IMF bailout, any revenue accrued will be seen as a means to bridging Ghana’s poor tax to GDP ratio rather than a strategic approach to improving healthcare delivery.

Should this happen, this will be a missed opportunity and one that could worsen the plight of many should they develop chronic diseases as the out-of-pocket component of Ghana’s health expenditure per capita will continue to rise. This will in turn make Ghana’s quest to achieve Universal health coverage (UHC) that requires that citizens are not at risk of financial hardship or impoverishment when seeking healthcare a tall order. At that point, this new tax would fail to be a health intervention and rather become a health risk.

Kwame Sarpong Asiedu (PhD) is CDD-Ghana’s Democracy & Development Fellow in Public Health.